I’ve done a lot of research into other DAOs recently, trying to find something consistent related to finance. My realization was that a lot of DAOs don’t get anything right, some DAOs get some things right and others wrong, but no DAOs make everything right when it comes to finance.

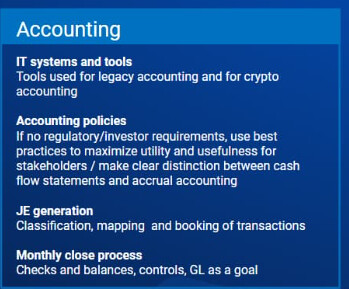

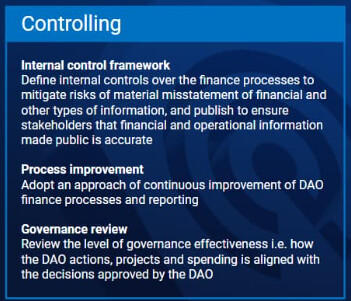

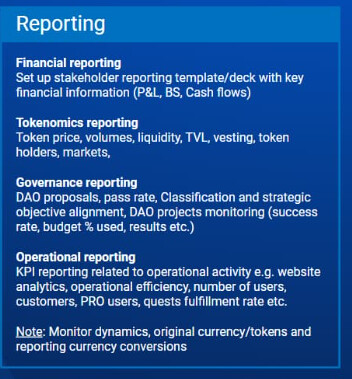

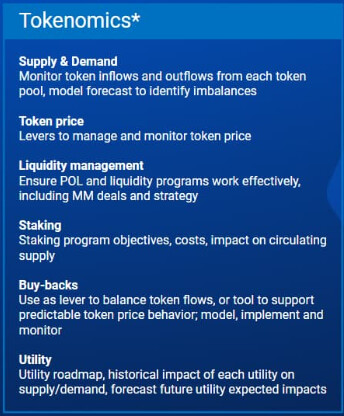

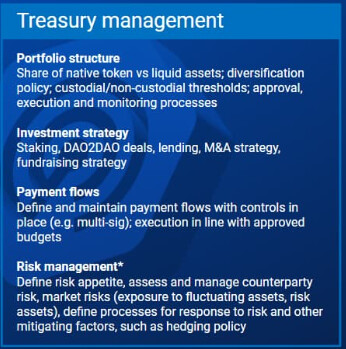

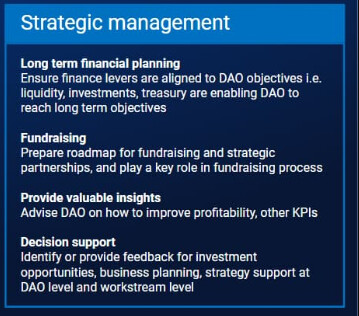

The confusion that I’ve seen the most is that finance in a DAO is the same thing as treasury management. Others focus on reporting (hooray!), but it’s cash based (on-chain); others set up transparent accounting policies, but it’s a mix of IFRS, FASB and personal choice.

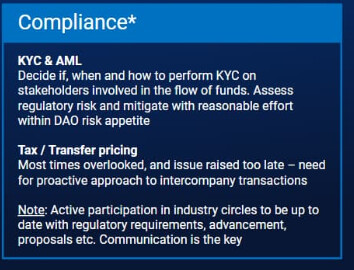

To add on top of that, we don’t even know what “right” is in this case. We know there is not regulatory clarity as to how to keep accounting for DAOs, no best practices, no reporting/disclosures requirements, all in all, there is no complete scope of DAO finance anywhere.

Until now.

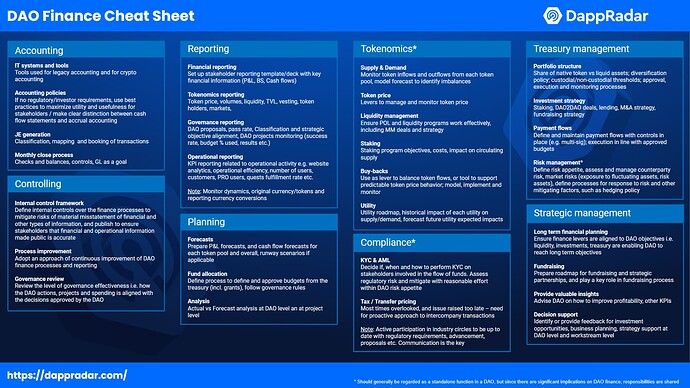

I’ve been acting CFO for a few financial services companies, worked in finance middle management in some corporate behemoths, and I’ve seen the other side as a financial auditor and management consultant, so I’ve used all this and my web3 experience at DappRadar to create a cheat sheet (as some call it) for DAO finance.

Nobody says that DAOs have to do all this. This can be used by DAOs for multiple reasons, such as:

- to assess their current finance function or workstream

- to understand if they’re missing any important, relevant activities

- to do a gap analysis and to plan a target finance scope for the future

- to prioritize the development of their DAO finance workstreams

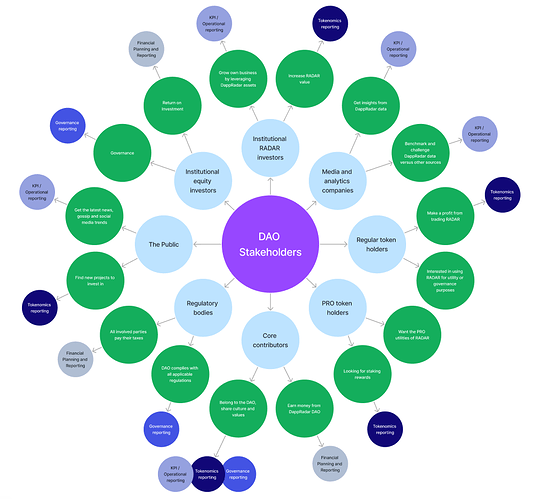

- to set up finance roles within the DAO, and clearly split their responsibilities, and their touch points with other workstreams (like compliance, risk, sales, product)

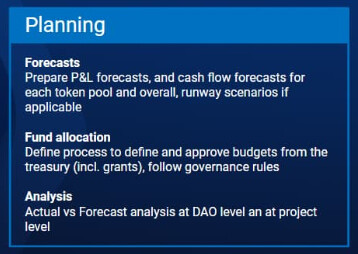

There is a lot to talk about for each of the topics and activities in the list. There definitely has to be a prioritization, like - for 2023 what we will need in DappRadar DAO will be to ensure bookkeeping is correct, controlled and timely, and we need to have most of the reporting in place, but let’s not forget about budget allocation for projects and workstreams and managing treasury risks.

This is the next step of what we’re doing - and community feedback will play an important role. Please do pitch in!

The goal is not ot have ALL of the DAO finance scope in the near future, but to know what we can do, decide what we need, and plan the path to achieve that.

I’m very much looking forward to what you think about this. In a way, this is the kick-off of the finance workstream, so let’s go!

Yours truly,

Bayar

PS: Working next on the details of the above, as well as payment flows and budget allocation process.