Hi @bayar

I have researched a lot in the past in this area, so I completely agree with you, I know the challenges you face, and I know what you are talking about.

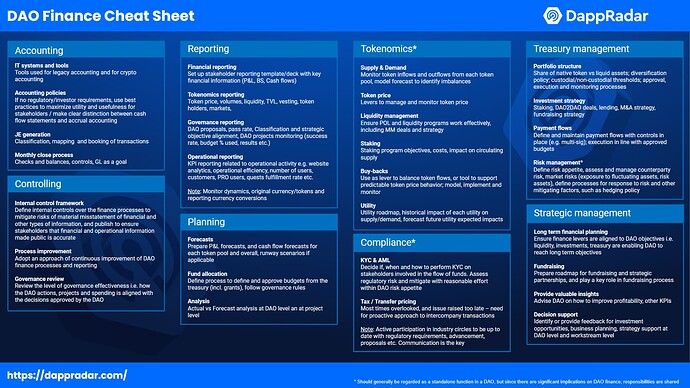

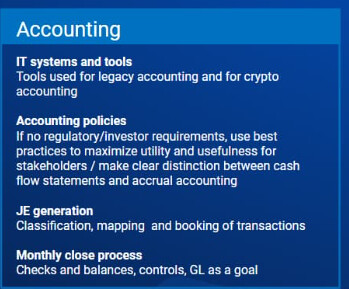

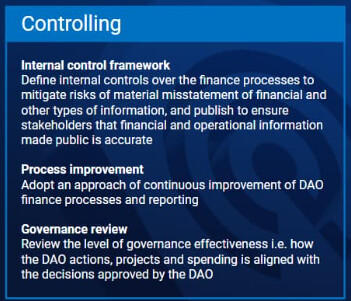

Almost all cryptocurrency projects and decentralized autonomous organizations (DAOs) that have appeared in our world from the beginning until the present time do not have any financial or accounting systems.

Very few DAOs have financial and accounting systems, and even among those DAOs that have financial and accounting systems, none of them have an integrated and ideal system.

And in these DAO communities that have financial and accounting systems, we can find just a few reports focused only on Treasury and may be some simple reports about profits and revenues, very simple budgets for the expenses of the various departments, and maybe very simple other reports, and that is all we can find.

Even if we find financial statements such as the income statement and the balance sheet, which are very rare to find in any DAO, we find them prepared in a way that avoids any accounting problems. We find some tricks to prepare them without solving the accounting and financial problems facing any accountant working in the field of crypto and decentralization.

There is nothing else published in any forum related to DAO, according to my information.

Also, if we search everywhere, we will never find accounting standards, fixed models, or anything written in a scientific manner that can help organize accounting and financial work in DAOs.

Financial and accounting work in DAOs has not had clear, well-known, and fixed rules until now.

Maybe this will change in the future, and standards and rules will emerge regulating financial and accounting work.

But currently all we have is personal appreciation and individual opinions for organizing financial and accounting work in DAOs

It requires a lot of discussion and a lot of work. Let’s take things step by step.

Let’s start with the first point you talked about, which is a problem in accounting for DAOs, and accountants often try to find tricks for it and avoid solving it.

Here I will mention my point of view.

You may find it correct or not. Let us discuss it to reach a solution, because, as I mentioned, there are no accounting standards directly related to it.

“For example, I’ve had a hard time actually identifying the equivalent of Equity in a DAO. This is because basically there are no shareholders. If we take the token value at TGE as equity, then how do we value it, at cost or fair value? And will it actually mean anything either way?”

You are once again absolutely right.

This is an example. In this link, we find the financial statements, but matters need more clarification.

But let’s discuss things differently.

For example, I created a blockchain network and launched it, and many people started running nodes related to it and performing operations on it.

Who owns it now? In fact, no one owns it, and no one can control it.

Even though I was the one who launched and created it.

Another example: I created and launched a decentralized autonomous organization (DAO).

Who owns it now? No one owns or controls it.

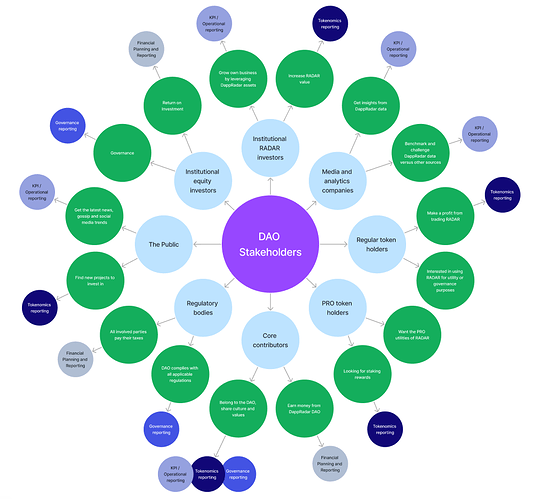

Maybe whoever owns this DAO cryptocurrency has voting rights and can participate in making decisions, but his ownership of this cryptocurrency does not mean at all that he owns any part of it. DAO has no shareholders and is not owned by anyone.

Its existence, continuity, and influence are not directly linked to its cryptocurrency.

We can create the DAO without a cryptocurrency.

It is a completely independent entity that has no physical existence and is not owned by anyone. No one controls it; we cannot catch it, but in the end, it exists.

Like any blockchain network, no one controls it or owns it.

This is the idea of decentralization, and this is the idea and essence of the Web3.

Now we have a clear concept.

No one controls the DAO, no one owns it, and it has no physical entity.

But in the end, it exists and can, like a real, natural person, own things and property.

Owning its cryptocurrency may mean having voting rights, but that does not mean at all that by owning its cryptocurrencies, we own a part of it.

So DAO has no shareholders.

A DAO is an intangible entity that exists and is able to own equity, so there is equity that a DAO owns.

We will just create an account by the name of DAO, and it will be an equity account. We will sum total assets, subtract from it total liabilities, extract the equity, and make the DAO account own this equity.

All cryptocurrencies in the treasury, whether Ethereum, Bitcoin, or any other cryptocurrency, or even project cryptocurrency itself, are treated like foreign currencies, and the same accounting standards related to foreign currencies apply to them.

This is just an opinion. You may agree or disagree with it, and I am open to discussion.

If we can resolve this point, we can move on to discussing another point.

![]()