@bayar

Thank you for your response and interest.

Please see the following reports: They are also from the same link and the same protocol.

Three different ways were used.

The second

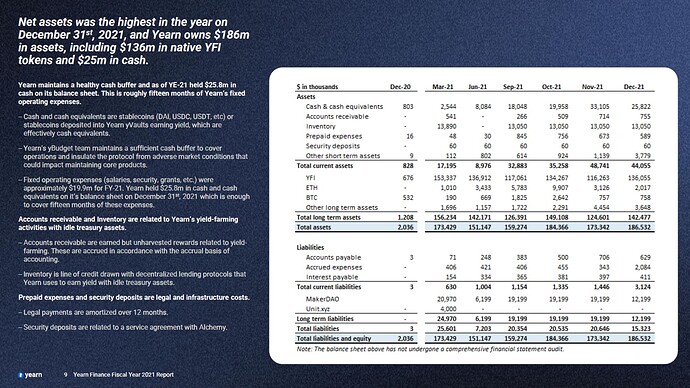

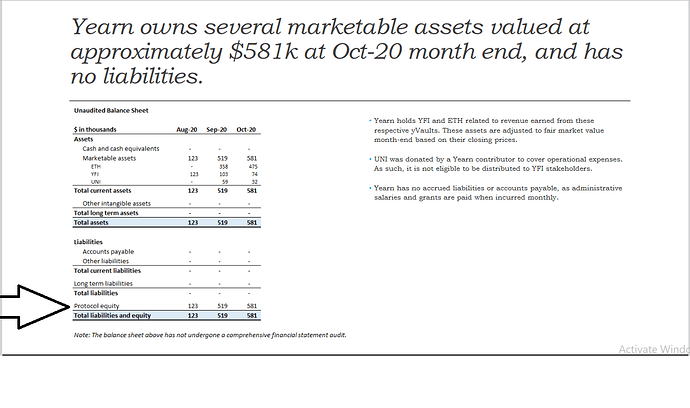

One time, the accountant used the Protocol equity account.

The second is that he uses the Total token holders equity account.

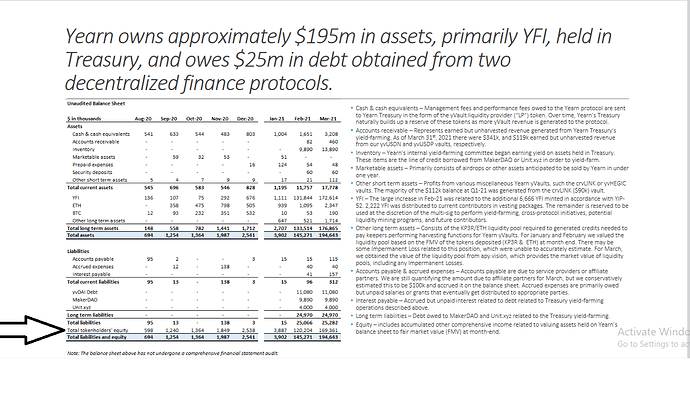

The third method is that the accountant did not use any account for equity and ignored the matter as if it did not exist.

All three methods were used in the same year.

I attached this link, not to take it as a model for us to build something like it.

I attached it as evidence of the confusion that exists in accounting for DAO organizations.

Of course, I examined it carefully before attaching it, and I know that he used three completely different methods.

One time, the accountant tried to put equity in the Protocol equity account, and then he thought he needs to change this policy

Once again, he tries to put equity in the total token holders equity account, and then he also thinks he needs to change this policy again

The third way he decided to make tricks and avoid all of that and not put any equity account in the balance sheet in this form has become unacceptable.

Because it is simply unbalanced, there is a difference between assets and liabilities.

He made a trick and said liabilities and equity without mentioning an equity account maybe to avoid a headache and this accounting problem.

And to protect himself, he added this to the beginning of all reports and by this way he avoids responsibility .

Although he is supposed to explain and defend the accounting policies he chose and why he chose to do what he did

The data, statements and information presented in this report is for informational purposes

only, and it does not constitute financial or investment advice. Further, the financial statements

presented have not undergone a comprehensive financial statement audit from a third-party

professional accounting firm. As such, there may exist errors or inaccuracies that materially

misstate the financial statements. We are not responsible for any financial losses or adverse

outcomes that may result from making investment decision based on the data presented

herein. Further, by viewing this report you agree that the statements in this report do not

constitute a representation, warranty or guaranty regarding any matter, and you are not relying

thereon, but will conduct your own due diligence. You hereby release, waive and relinquish any

and all claims, causes of action and disputes against Yearn Finance, its contributors, and the

creators of this document. THIS REPORT DOES NOT CONSTITUTE ADVICE FOR ANY PURPOSE.

The forward-looking statements in this report are subject to numerous assumptions, risks and

uncertainties which are subject to change over time. There are many risk factors, including

those relating to blockchain and cryptographic technology generally, as well as Yearn

specifically, that could cause actual results or developments anticipated by us not to be realized

or, even if substantially realized, to fail to achieve any or all of the benefits that could be

expected therefrom. We reserve the right to change the plans, expectations and intentions

stated herein at any time, and we undertake no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future developments or

otherwise. ACCORDINGLY, WE RECOMMEND THAT YOU DO NOT RELY ON, AND DO NOT MAKE

ANY FINANCIAL DECISION OR INVESTMENT BASED ON, THE STATEMENTS CONTAINED IN THIS

UPDATE — INCLUDING BUT NOT LIMITED TO ANY SELLING OR TRADING OF YFI TOKENS, ETHER

OR ANY OTHER CRYPTOGRAPHIC OR BLOCKCHAIN TOKEN.

And many balance sheets and income statements that we find for DAO organizations, they add similar sections because they know very well that it is not ideal and has problems, and they did not think and research to find accounting solutions and defend them. They took the easy path.

I am not against the idea “create a new definition of a DAO’s net assets”

But from my experience, I have an opinion.

The solutions to all accounting problems for DAO organizations will be very easy if we first try to find the most accurate description of the web3 elements.

The first element we need to describe in a true and accurate way is “decentralized autonomous organization (DAO)”.

It is clear to me that you are very keen in your work to reach the optimal accounting policy and you research a lot, and you are not like others who rely on accounting tricks.

That’s great, so it makes sense that you wouldn’t trust my opinions easily. You want to form your own opinions that you trust.

Therefore, I have a suggestion that search in a different direction, to search for the exact definition of decentralized autonomous organization (DAO)

The definition you will reach will help you follow the correct accounting policy.

You can place in the introduction to the financial reports a section in which you place all the definitions you have arrived at to define the DAO and other Web3 elements related to financial reports. Therefore, you can also set the accounting policies that you have chosen, which are based on the definitions of the DAO and other Web3 elements.

In this way, we will end the controversy completely, and you will protect yourself, and no one will be able to object to these reports and financial statements because there is an explanation of why we used these accounting policies.

So in the end, if you found the definition of the decentralized autonomous organization (DAO)

Like what I mentioned before

Is it really an independent, intangible entity that no one can own it , and the holders of the cryptocurrency, can not own any part of it - they only have right to vote - and at the same time , it is an entity capable of owning money and property like a natural person.

Meaning that it is an organization that can own things, and in same time no one can own any part of it.

Like the blockchain network, no one can own it.

Or does it have another definition?

If yes you will find yourself using the same solution that I suggested, and if you find it different, it is possible to use another solution. You will find this solution appearing directly to you once you determine the most accurate description of the decentralized autonomous organization (DAO).

I am interested in this matter, and the results you will find will benefit me personally and may benefit many other DAO organizations. As you can see, there are many accounting problems.

I am always available and open to discussion and assistance.

If we can reach an accurate model of accounting in DAO organizations, it will certainly help many, and you will certainly share it with others once the reports are published here in the forum.

Then it will be possible for everyone to create something like it.