DAO treasury management insights

DAO treasury management is an important but I will talk in this topic in general

What is the best system for managing it?

There is no definitive answer to this because it varies from one organization to another

There are many points and questions we should thinking in before building any treasury management system to any DAO

In fact, building a system and policy for treasury management is completely different from one organization to another ,It does not have a fixed form, but is determined according to the different goals and circumstances of each organization

But through the following points, thinking and answering them, the correct system for treasury management can be drawn

Risks and Questions

1.The cryptocurrency market is currently down which means that the price of cryptocurrencies is not stable whether it is the native token or any other tokens that may be in the treasury

2.Inflation and depreciation of major currencies such as the dollar and the euro even stable coins are not currently secured

3.The current global economic crises that affect all markets and industries, not just the crypto industry

3.The treasury can be hacked through any security weak point

4.Losing access to the treasury is a low probability, but it can happen

5.Multiple signatures system should be used so that not only one person can control the treasury individually

6.Will DAO leave cryptocurrencies in the treasury without any investment??

or part of it will invested?

7.Will we look for a completely safe investment only, or will there be a part that can be invested in things that have higher profits and risks?

8.Is it possible to invest a part in NFT?? Or in currencies and tokens for other promising and emerging crypto projects??

9.Is there an intention to buy large quantities of a cryptocurrency for another project,

to control this project and control in decisions in it and make this project integrate or serve the original project ??

10.holding native token in the treasury is logical but should only native token be holding ?? or treasury need to diversification?

-DAO needs Stablecoins (DAI, USDC, etc) for operating expenses

-native token may drop suddenly at some times, especially during crises

-Diversifying the treasury may save the organization from decline and help it correct the situation and make native token protected

-Keeping stablecoins and cryptocurrencies such as Ethereum and Bitcoin in the treasury can be a good thing

-ETH is until now the is so important to crypto and to future of crypto industry

-BTC is Until now the most important and most famous in crypto industry, and it is also an industry indicator

-Most of the stablecoins are linked to the US dollar although there is always the possibility that it will decrease and disappear and it is not completely safe but it is a good guarantee

-Therefore, the best distribution is between native token as a basic and add to treasury Ethereum, Bitcoin and stable currencies, and adding other cryptocurrencies and another part to promising cryptocurrencies ,in my opinion, the diversification may be useful

11.Is it better to keep high liquidity?? or invest the cryptocurrencies in the treasury and keep only the necessary liquidity to meet the operational expenses??

-What is the amount of liquidity that should be maintained?

12.Is there an intention to try to raise the value to native token??

or the intention to maintain its current price?? or is there a desire to reduce it?

13.Is there a desire to increase the demand on buying the native token??

14.Is there a desire to rationalize spending so that cryptocurrencies are injected into other investments?? or develop existing products??

-Treasury management is certainly influenced by management objectives

The answers to the previous points is never the same, and policies differ from one organization to another and the answers determine the way to manage the treasury

Let’s see different models

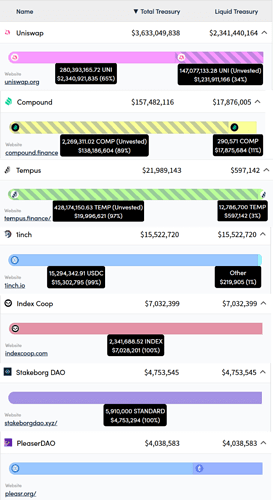

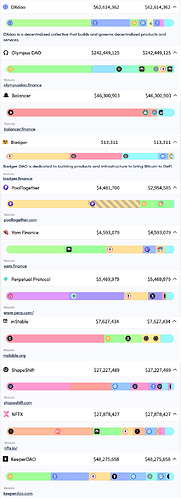

I got the data from the following website https://openorgs.info/

we can see some models

In this models the treasury it has no diversity but contains native token only or few cryptocurrencies

Other models diversification exists and in a different way some organizations the treasury contains multiple cryptocurrencies with a good variety ,native token token with stable coins with Ethereum and other currencies

In my opinion, the second system is better, perhaps not suitable for everyone, but from my point of view, it may be safer

The topic is for discussion and I hope community members will contribute their opinions in the comments