Hello everyone! I’m back—it’s been a month since my last post here, so it’s time to push things forward again. In this post, I’ll continue to share my questions along with some relevant suggestions.

Today, I’ll be diving into the following topics:

- The relationship between DappRadar’s brand influence and its token market cap performance

- The impact of market maker strategies

- The importance of community sentiment

The Connection Between DappRadar’s Brand Influence and Token Market Cap Performance

First, it’s important to recognize that DappRadar is a leading platform in the crypto industry. As stated on their official website: “We’re the #1 global NFT & DeFi dapp store.” They’ve received investment from prominent institutions like Prosus (Naspers Ventures), Blockchain com Ventures, Angel Invest Berlin, and NordicNinja VC, raising a total of $7.33 million. With over 40 employees and a monthly user base of 1 million, it’s clear that DappRadar is a strong company with a solid product, institutional backing, talented staff, a large user base, and significant industry influence. From any angle, this is a company worthy of long-term value investment.

Additionally, DappRadar is actively advancing its DAO initiatives, with a robust governance structure, legal support, and transparent financial reporting—all of which indicate stable development.

Given such impressive data and background, one might expect that investing in DappRadar’s token, $RADAR, would be a sound long-term decision. However, we face a stark reality: $RADAR’s performance has been dismal!

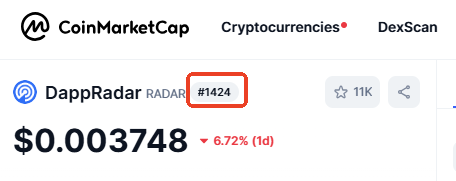

Looking at its valuation, $RADAR has a circulating market cap of only $4.7 million, ranking 1421 on CoinMarketCap. Considering that DappRadar is nearly the top platform in its field and has raised over $7 million, this market cap seems unreasonable.

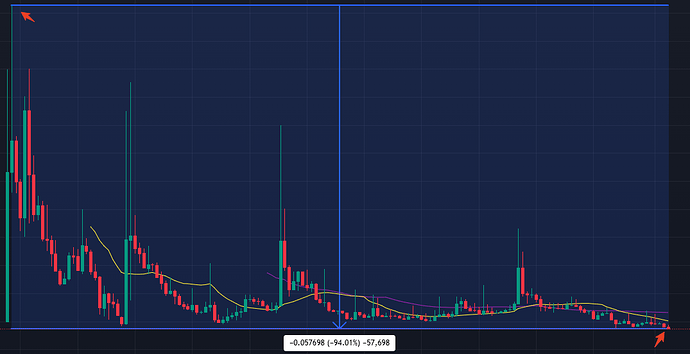

Examining price fluctuations, since its launch in December 2021, $RADAR has plummeted by 94.01%, continuously hitting new lows. Such a significant and persistent decline is typically seen in failing, bankrupt, or even fraudulent projects—again, this is not reasonable. So where is the bottom? $0.003? $0.002? $0.001? I urge everyone to think about this.

As for empowerment, $RADAR has launched the PRO program, offering benefits to participants, which is a positive direction. However, it’s concerning that we see little to no promotion of $RADAR across media, KOLs, or YouTube channels. There’s even a lack of widely known buyback information; all communications seem confined to community forums, like a hidden treasure in a closed room that no one knows about, while the team appears reluctant to open the door.

On behalf of the community, I suggest that the team actively disseminate information about the DappRadar platform and $RADAR token. They should engage in regular media disclosures and outreach to expand community building, stabilize the value floor, and attract more investors to collaboratively drive the platform’s growth.

The Impact of Market Maker Strategies

Currently, our collaborating market maker is GSR, a well-known player in the industry that has provided services for several prominent projects. There are various market-making strategies, such as bid-ask spreads, algorithmic trading, high-frequency trading, and arbitrage. Based on our observations and available public information, it appears that DappRadar’s partnership with GSR is relatively straightforward. For example, it may involve issuing token loans and providing basic liquidity. The contract duration is typically six months, twelve months, or longer, depending on DappRadar’s needs. During this period, GSR engages in swing trading to generate profits, returning the tokens at the end of the partnership. We can see records of such activities on blockchain explorers, and earlier partnerships, like with Wintermute, followed a similar pattern.

This basic type of collaboration has significant downsides. Market makers don’t need to consider the impact of their pricing strategies on the project’s brand; they merely conduct transactions to profit, which can severely damage the brand value for genuine investors and the project itself.

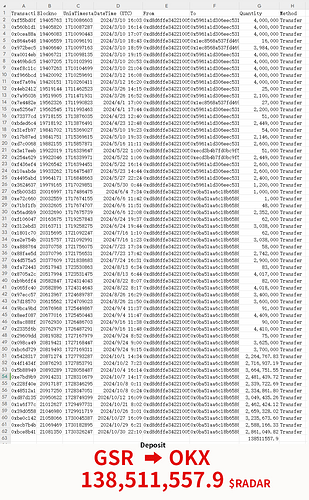

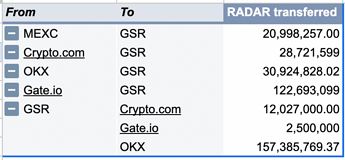

In my first post, I detailed GSR’s aggressive sell-offs, and today I’ll again illustrate how GSR is undermining the value of $RADAR.

From March 10, 2024, to October 21, 2024, GSR transferred a total of 138,511,557.9 $RADAR tokens to OKX, with the price plummeting from $0.021 to $0.0037—an astonishing drop of 82.57% (to recover, the price would need to increase by 5.7 times). This drastic decline is alarming and has also shattered the two-year price floor of $0.004 maintained by Wintermute, while GSR continues to offload tokens.

How can we accurately demonstrate GSR’s sell-off? GSR has transferred a total of 138,511,557.9 $RADAR to OKX.

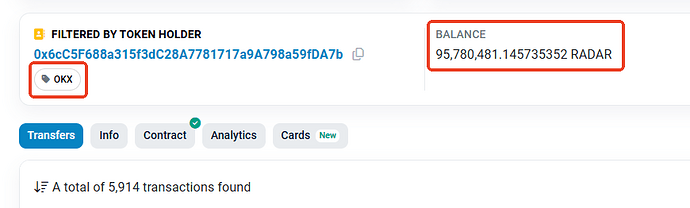

As of October 31, 2024, OKX’s balance shows 95,780,481.1 $RADAR, with the reduction attributed to withdrawals by MEV bots and other users. Therefore, our focus should be on the remaining balance.

A portion of OKX’s balance consists of holdings by exchange users. By making some simple calculations, we can estimate the following: Assuming that user holdings on the exchange are approximately 30% to 50% of the total, this amounts to about 28,734,144.33 to 47,890,240.55 $RADAR. Thus, GSR’s actual holdings on OKX are approximately 50% to 70%, which equates to roughly 47,890,240.55 to 67,046,336.77 $RADAR.

Since GSR has a cumulative deposit of 138,511,557.9 $RADAR, we can deduce that GSR has sold approximately 71,465,221.13 to 90,621,317.35 $RADAR.

Given that the selling has been ongoing, we’ll take the midpoint between the highest price of $0.022 and the lowest price of $0.003736, which gives us an approximate price of $0.025736.

This leads us to estimate that the total value of GSR’s cumulative sales is between 1,839,228.9 USDT and 2,332,230.2 USDT.

It should be clear to everyone that GSR has been aggressively offloading tokens, and the price continues to set new lows.

Returning to the OKX exchange, the depth chart reveals that the sell orders amount to 11.3 million, while the buy orders total only 1.63 million—a difference of about seven times. If the price collapses, it could lead to an endless downward spiral. We believe that GSR has not effectively managed the $RADAR token.

I hope these details will catch the attention of the DappRadar team. We are formally requesting for the second time that the team reevaluate GSR’s primitive, rudimentary, and aggressive “vampire strategy” market-making style. It’s crucial to instruct market makers to maintain at least basic strategic standards, provide ample liquidity, and uphold fundamental value performance. The ongoing relentless sell-offs must stop. In comparison, I believe Wintermute performed much better, but unfortunately, that partnership has ended.

The Importance of Community Sentiment

The community is vital for projects in the cryptocurrency industry. DappRadar has made commendable efforts in community building by establishing Discord and community forums, which effectively provide a platform for free expression and maintain a sense of order—this is a positive development.

However, since I posted an article a month ago, it seems the DappRadar team has not provided any feedback and appears to be avoiding the issues surrounding market makers and pricing. This is puzzling; I believe there should be proactive communication with the community. Whether the news is good or bad, it’s essential to confront it head-on, identify the reasons, and seek solutions.

We are community builders, DappRadar users, and $RADAR investors. Everything we do ultimately ties back to price, as price performance reflects the value of what community members are contributing.

I urge the DappRadar team to engage actively with the community and work together to build a better future.