Hello everyone,

First, please allow me to introduce myself. I am a long-term holder of $RADAR and a seasoned investor and user in the cryptocurrency space. My journey in this industry dates back to 2016, and I have experience as a practitioner as well. Currently, I focus on both primary and secondary market investments.

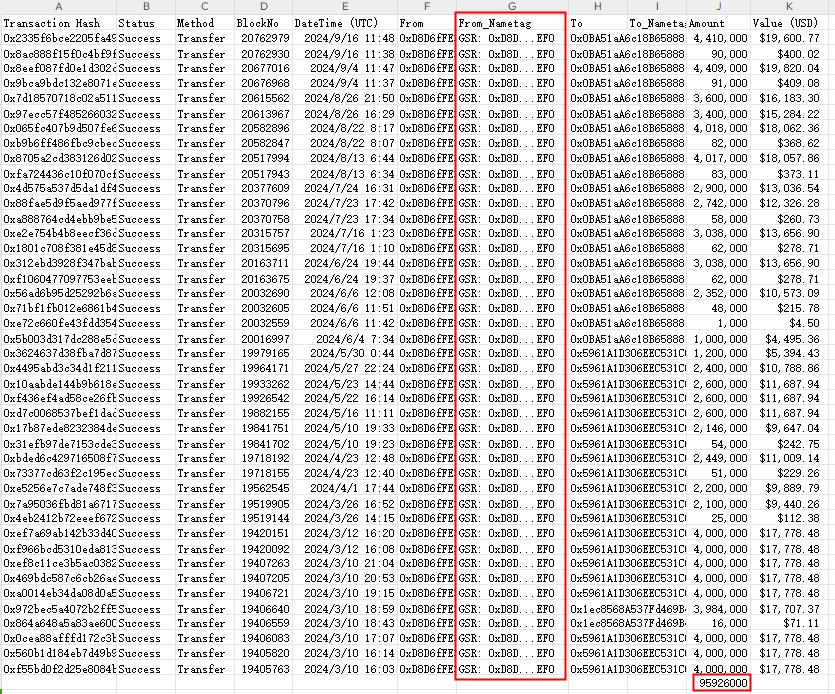

Today, I would like to initiate a discussion primarily centered around GSR, the market maker for DappRadar. Below, I will analyze this topic using charts, and I welcome participation from the team and community members.

Core Question: Has GSR fulfilled its role as a market maker?

First, let’s understand what a market maker is. The primary task of a market maker is to provide liquidity, which means that the market can easily and quickly convert assets into cash without significantly affecting their price. Market makers place orders on their trading desks to buy and sell cryptocurrencies, ensuring that supply and demand are always available so that other market participants can trade at any time.

Now, let’s take a look at what GSR has done.

Since March 10, 2024, GSR has continuously transferred $RADAR to OKX, with a total of 95,926,000 tokens moved. Subsequently, the price fell from $0.022 to a historical low of $0.003758, representing a drop of about 82%. While the overall market has seen a downturn, we should consider one question: who is selling? Who failed to hold the line and created this historical low price? Throughout this process, did GSR fulfill its responsibilities as a market maker? If you have different insights, please join the discussion.

Let’s continue to examine the issue of liquidity. Recently, a community member raised concerns about liquidity, and in response, the team proposed allocating 50 million RADAR to our strategic market-making partner to boost liquidity on major exchanges. This proposal has now been approved and is awaiting implementation.

Currently, liquidity on OKX is severely lacking. We’ve noticed that the liquidity orders are quite small, typically ranging from 1,000 to 2,000 $RADAR, which amounts to only a few dollars. Users find it difficult to buy their desired positions from the order book, and the daily trading volume is very low. This is concerning and prompts us to reconsider whether the market maker GSR has fulfilled its responsibilities.

Next, let’s look at price fluctuations. In recent days, influenced by macro news regarding the Federal Reserve’s interest rate cuts, cryptocurrencies have seen significant increases. We can easily observe that $RADAR’s price change has been hovering around a 1-2% increase, which is far below the performance of most other tokens. This is hard to believe. If the overall market decline is acceptable, then why is there such indifference during an upward movement? Has the market maker truly played a real role? Or is it possible that the market maker hasn’t been active? This phenomenon certainly warrants our consideration.

Finally, we need to discuss whether the team is satisfied with the performance of the market maker. Since the token was launched at the end of 2021, its price has dropped from a high of $0.0614 to a low of $0.003758, which is an unsettling decline. Although the DappRadar platform continues to update and explore, achieving many notable accomplishments, the performance of the $RADAR token has been disappointing, leaving long-term holders frustrated.

The platform has achieved many remarkable milestones, including producing high-quality industry reports, connecting with various types of projects, improving data presentations, working to increase buybacks, providing different benefits for stakers, expanding liquidity across multiple chains, and actively building a DAO. Unfortunately, all of this has been overshadowed by the ongoing price decline, which is truly regrettable. The circulating market cap of $RADAR is only $5 million, clearly indicating that its value is undervalued. It seems that the market maker is primarily focused on making profits and is not interested in maintaining brand influence through price performance. This is quite concerning in the long run, and necessary actions should be taken.

My suggestion is that the team should engage in deep discussions with the market maker to provide ample liquidity for the token within exchanges, increase order book depth, and put an end to the endless selling of tokens. This would help establish a reliable bottom price for market investors, boost investor confidence, and create opportunities for users, the platform, investors, and the team to grow together in the long term.