Summary

Last year, DappRadar DAO was able to ensure stable price action on RADAR by accumulating $1M worth of liquidity on Ethereum, with SushiSwap as our main decentralized exchange. With the most recent extension of liquidity provision rewards coming to an end, it is necessary to reevaluate our current incentivisation program on the SushiSwap DEX.

In this Proposal, we propose to continue the Sushiswap rewards at a reduced rate.

Motivation

SushiSwap and Crypto.com Exchange are leading in terms of volume for RADAR trading and it is important to have centralized and decentralized markets with liquidity. In decentralized markets, rewarding Liquidity Providers (LPs) through farms is important. Although it has a significant cost to DappRadar DAO, it ensures lower slippage and deep depth of our market liquidity, which attracts more RADAR holders. We want to maintain the traction on SushiSwap in regards to liquidity providers and liquidity depth moving forward to ensure a stable value of RADAR.

Abstract

Last year, we had three SushiSwap campaigns decided upon by the DAO. We allocated 190M tokens as rewards for liquidity providers to ensure that RADAR had a stable price and depth. We were able to grow to 213 liquidity providers.

By working with ApeSwap, we were able to reduce the number of RADAR rewards used by 213.5M, increasing the efficiency of our cross-staking program and making the liquidity allocation more efficient with ApeSwap. This means that we are able to sustain the rewards over a longer period of time, giving more opportunities for new liquidity and users to hold RADAR and become part of our DAO.

As mentioned in the previous DCP-4, when deciding the number of rewards for liquidity providers, it is important to consider how that will affect the liquidity in the pool, the token price, and the benefits for the DAO too. This is even more vital on Ethereum where the gas fees are generally higher compared to other chains. Additionally, we are in the process of updating our Tokenomics in regard to gamification, staking and operational costs. Therefore, we are continuing to monitor these revenues and costs while evaluating other sustainable liquidity programs such as our ongoing Treasury Bills campaign with Apeswap.

We have been running our Liquidity Mining Programs on Sushiswap for ~12 months and at the time of writing, the RADAR-ETH pool on Sushiswap has ~$1M liquidity. The ending date of our most recent SushiSwap’s Liquidity Mining Program will be finishing in January.

For the next extension of LP rewards, we would like to once again use the remaining unclaimed Airdrop tokens and reduce the previously allocated rewards for Sushiswap by 20% to extend farming on SushiSwap 2x Farm for 90 days (3 months) with a reduced total of ~25,600,000 RADAR at a rate of ~284,445 RADAR per day.

Benefits

- Extending the rewards for loyal RADAR holders and LPs on the Ethereum chain

- Maintaining our cross-chain narrative by ensuring exposure to Ethereum users to gain access to providing liquidity to DappRadar

- Maintaining and potentially increasing liquidity in the RADAR-ETH pool while optimizing the costs and enabling low slippage for DEX trades

Drawbacks

- The potential drop in liquidity if rewards are reduced

- Distributing a large proportion of RADAR tokens that could be used for other initiatives

Vote

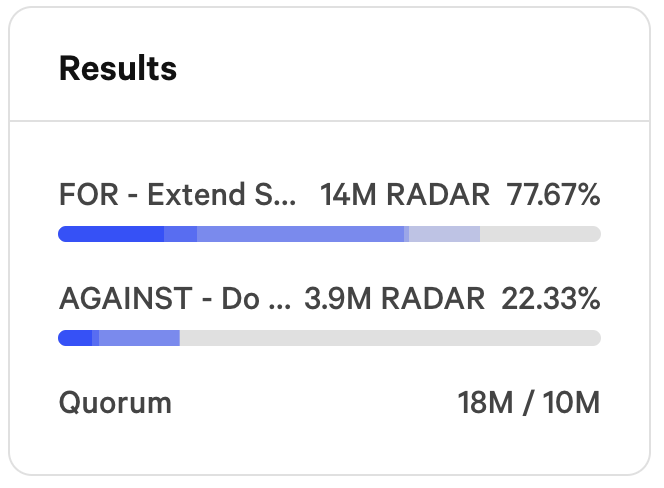

- FOR - Extend farming on Sushiswap 2x Farm for 90 days (3 months) with a reduced total of 25,600,000 RADAR at a rate of 284,445 RADAR per day

- AGAINST - Do not extend farming on Sushiswap 2x Farm