Co-Authored by: DappRadar (@SkirmantasJ, @dragos, and @vandynathan) and @ApeSwapDAO

The Snapshot vote has been confimed and it is decided that we will restart the ApeSwap Treasury Bills program

Summary:

Liquidity is an important part of RADAR, and therefore our DAO’s success. Out of the two current options of liquidity programs, the DAO is now making use of rented liquidity and Protocol-Owned-Liquidity. Rented Liquidity is a heavy operational cost, whereas Protocol-Owned-Liqudity (POL) allows the DAO to create more sustainable liquidity and provides treasury revenue long-term.

Our DAO must consider token liquidity and treasury management as two important parameters for RADAR’s long-term price stability, ease of trade for RADAR investors and traders, and runway for the DAOs operations.

In this DCP, we’re proposing to increase the DAO’s Protocol-Owned-Liquidity by setting up a new Treasury Bills campaign on ApeSwap.

Motivation:

Rewarding Liquidity Providers (LPs) through farms and acquiring Protocol-Owned-Liquidity are both very important. The former ensures deep depth and low slippage and the latter increases the DAO’s control over liquidity in the market.

There is some traction on ApeSwap in regards to liquidity, treasury revenue, and users, and would like to slowly reduce the reliance on rented liquidity and increase the volume of Protocol-Owned-Liquidity.

Abstract:

As the World’s Dapp Store, DappRadar DAO has an important role in ensuring the balance of our RADAR token and a long runway to afford our operation costs including contribute-to-earn, Bounties, more gamification, and open-source development.

In order to scale the mission, it’s our responsibility to ensure good treasury practices and minimize our operational costs. That involves ensuring that our token has a stable price and deep liquidity so that it can be effectively traded by our DAO members, contributors, and partners.

The previous proposals here and here, have shown that we have been able to apply good treasury management using the unclaimed Airdrop tokens as rewards for our Liquidity Providers.

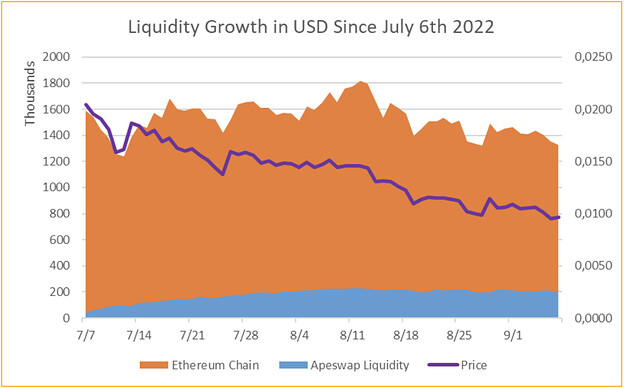

The two Liquidity Platforms that we have currently used are SushiSwap and ApeSwap. SushiSwap is known as rented liquidity, as you have to keep paying the Liquidity Providers a certain amount of tokens every period to maintain the Liquidity: as soon as you stop renting the Liquidity, it disappears. This method is quite attractive in the short term as it allows us to get a healthy level of liquidity rather quickly. However, it puts a burden on our treasury and is not very sustainable long term.

The other option is ApeSwap which additionally offers a liquidity program known as Treasury Bills, providing us with POL. Instead of renting the liquidity, it is better understood as a rent-to-own program: we allow Liquidity Providers to swap their LP tokens for RADAR at a discount and also an NFT that represents their treasury bill. Ultimately, DappRadar DAO owns the liquidity rather than having to spend our tokens on incentivizing investors to provide liquidity – liquidity that can be used on multiple chains.

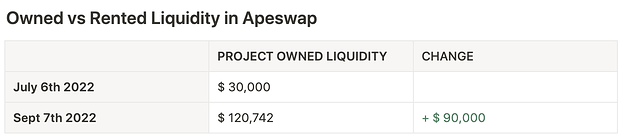

To get a better understanding of how this makes a difference, on SushiSwap we were initially rewarding Liquidity Providers ~555k RADAR/day to achieve a liquidity of $1,590,552. This was a pure sunk cost to our DAO. On the other hand, we were rewarding Liquidity Providers on ApeSwap 261k RADAR/day through the rewards, which led to us own $120,742 in POL and achieving a liquidity of ~$200,000.

In conclusion, while maintaining sufficient liquidity on BNB, for every $1 that we spent, we received $0.87 (pre-ApeSwap success fee). Instead of liquidity becoming an operational cost, it became an asset.

After working closely with the team at ApeSwap DAO, we have already begun reducing the incentivization of rented liquidity and increasing the incentivization of protocol-owned-liquidity. By lowering Sushi’s rewards and APR by 20-25%, it had minimal impact on liquidity in Sushi’s protocol but lowered our expenses by 20%. The amount of savings achieved equates to $360K per year approx.

Following this, it makes sense to continue this trajectory of reducing our spending on rented liquidity and increasing the rewards on ApeSwap, expanding our treasury and runway, and reducing operational costs.

We propose:

- 40,769,233 RADAR (~226k/day) total over the next 180 days in ApeSwap Treasury Bills. At the current spot price that is ~$300k worth of RADAR

- Liquidity Providers would be able to swap their BNB-RADAR LP tokens at an increased value for RADAR that will be vested for 30 days and also receive an NFT that represents the treasury bill. The vesting period can be adjusted along the way to ensure better performance of the campaign

- We would provide periodic updates on the progress of this campaign

Benefits

- Extending the rewards for the growing number of RADAR holders on the BNB chain

- Increasing our volume of protocol-owned-liquidity while reducing reliance on rented liquidity

- Avoid sudden drop in liquidity if rewards are expiring

- Maintaining our cross-chain narrative by ensuring exposure to Ethereum and BNB Chain users to gain access to providing liquidity to DappRadar

- Maintaining and increasing liquidity in the BNB-RADAR pool

Drawbacks

- Distributing a large proportion of RADAR tokens that could be used for other initiatives

Vote

-

- FOR: Allocate 40,769,233 RADAR for the ApeSwap Treasury Bill program – to increase the protocol-owned liquidity in our DappRadar DAO treasury

-

- AGAINST: Do not extend the Treasury Bill protocol-owned-liquidity program