Summary:

DappRadar DAO has been continuing its transition of providing the community with more control by rewarding investors with more RADAR tokens. During the process, we noted the cost benefits of earning Protocol-Owned-Liquidity through ApeSwap Treasury Bills as opposed to no additional owned Liquidity through SushiSwap.

In this Proposal, we suggest continuing the SushiSwap rewards at a reduced rate, and we evaluate the reasoning for a following Proposal, where we would increase DappRadar’s Protocol-Owned-Liquidity by incentivizing more investors through our ApeSwap Treasury Bills.

Motivation:

Rewarding Liquidity Providers (LPs) through farms and earning Protocol-Owned-Liquidity are both very important. The former ensures deep depth and low slippage and the latter increases the DAO’s control over liquidity in the market.

We would like to continue with SushiSwap due to the traction in regards to Liquidity and the number of investors, whilst also increasing our volume of Protocol-Owned-Liquidity through ApeSwap Treasury Bills.

Abstract:

Initially, we expected to use 652M tokens for rewards over the course of 10 months. Instead, we were able to reduce the number of RADAR used by 213.5M due to the increased efficiency of cross-staking, efficient liquidity allocation with ApeSwap and by decreasing the SushiSwap liquidity rewards. This means that we are able to sustain the rewards over a longer period of time, giving more opportunities for new liquidity and users to hold RADAR and become part of our DAO.

We also recognize that the team is required to give increased transparency over how the DAO funds are used, and we will soon be implementing this process. A more detailed breakdown of the expenses on the unclaimed airdrop tokens is as follows:

-

We expected to spend 250,000,000 (on Single Staking) + 50,000,000 (on Extended liquidity Rewards) + 352.000.000 (on Multi-chain expansion) totalling 652M tokens in ten months.

-

Instead we spent 100,000,000 (on Single Staking) + 90,000,000 (Extending SushiSwap liquidity Rewards) + only 23,500,000 tokens (Multichain expansion) totalling 213.5M in ten months.

-

With a saved balance of ~ 438.5M, we have sufficient tokens to extend the liquidity rewards in order to maintain a growing number of investors in RADAR across chains and a stable RADAR price.

The ending date for SushiSwap’s Liquidity Mining Program will be finishing by the 15th of October. When deciding the number of rewards for liquidity providers, it is important to consider how that will affect the liquidity in the pool, the token price, and the benefits for the DAO too. We reviewed the statistics of the previous two Liquidity Programs from SushiSwap and ApeSwap and noticed some important differences:

At the time of writing, the RADAR-ETH pool on Sushiswap has $1.02M liquidity and RADAR-WBNB pool on ApeSwap has $166.57K liquidity.

We have been running our Liquidity Mining Program on SushiSwap for ten months and on ApeSwap for three months now. Please view the following blog (https://dappradar.com/blog/dappradar-and-apeswap-radar-liquidity-mining-program) for more information on our ApeSwap Program.

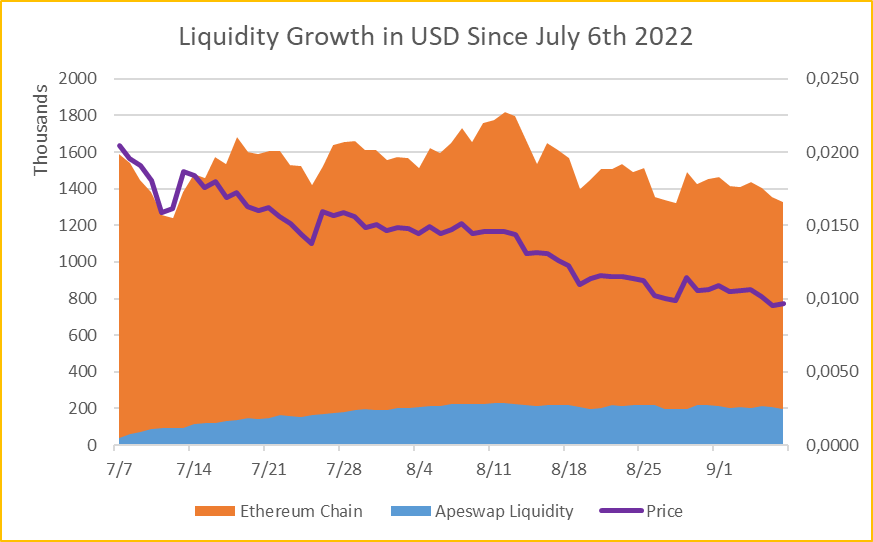

Although it costs us to rent out liquidity on SushiSwap, with ApeSwap we are able to earn protocol-owned-liquidity over time, and in fact, increased the volume of liquidity we owned from $ 30,000 on July 6th 2022 to $ 120,742 on Sept 7th 2022. That’s an increase of $ 90,000 for the DAO.

Additionally, whereas the liquidity on our Ethereum Chains decreased over time, with ApeSwap it actually increased, emphasizing the advantages of ApeSwap’s Treasury Bills (view graph below).

By reducing the rewards on SushiSwap by 20%, although the APR also fell by ~20%, we were able to maintain stable liquidity on the DEX while reducing the cost of renting our liquidity by roughly $360,000 per year.

Based on this calculation, it is more cost-efficient for us to continue the reduced rewards on SushiSwap and instead incentivize liquidity on ApeSwap.

For the next extension of LP rewards, we would like to once again use the remaining unclaimed Airdrop tokens and reduce the previously allocated rewards for SushiSwap by 20% and extend farming on Sushiswap 2x Farm for 90 days (3 months) with a reduced total of ~32,000,000 RADAR at a rate of ~355,556 RADAR per day.

Benefits:

- Extending the rewards for loyal RADAR holders on the Ethereum chain

- Maintaining our cross-chain narrative by ensuring exposure to Ethereum users and investors to gain access to providing liquidity to DappRadar

- Increasing the pool of rewards available for the DAO to amass more protocol-owned-liquidity

- Maintaining and potentially increasing liquidity in the RADAR-ETH pool

Drawbacks:

- The potential drop in liquidity if rewards are reduced

- Distributing a large proportion of RADAR tokens that could be used for other initiatives

- FOR - Extend farming on SushiSwap 2x Farm for 90 days (3 months) with a reduced total of 32,000,000 RADAR at a rate of 355,556 RADAR per day

- AGAINST - Do not extend farming on SushiSwap 2x Farm