Co-Authored by: DappRadar (@dragos, @SkirmantasJ and @vandynathan)

Summary

With a liquidity volume of $1M on Ethereum, primarily concentrated on Sushi, by extending liquidity provider (LP) rewards and migrating to Sushi V3, we aim to optimize liquidity provision in line with industry best practices. This proposal aims to extend the LP rewards for the Sushi Liquidity Pool and discuss the migration of RADAR liquidity to Sushi V3.

It suggests extending the current Sushi V2 LP staking program at the existing rewards rate of 213,333 RADAR per day and a total of ~19,200,000 RADAR over a period of 3 months. This proposal maintains the same parameters as the previous extension proposal (DCP-9 v2).

During the next 3 months, there will also be a switch of rewards from Sushi V2 pools to V3, details which will be expanded further in the proposal.

Motivation

The motivation behind this proposal is to extend the Sushi LP rewards and continue with the preparation for a V3 migration that will help to optimize liquidity provision, improve user experience, and align with industry trends. By continuing to plan the migration of the liquidity to Sushi V3, it will have benefits like concentrated liquidity leading to lower slippage. This strategic move will position us to optimize the RADAR rewards necessary to incentivize, ensure alignment with the latest liquidity solutions, and reduce dilution towards the RADAR token.

Abstract

Evolving from rented to sustainable RADAR liquidity

For the past year, we have been steadily decreasing the liquidity rewards on Sushi to ensure that we are incentivizing the right volume of liquidity to match the volume of trades in the RADAR ecosystem. This optimization is one of the important features of sustainable liquidity.

Incentivizing liquidity is one of the highest costs sinks in for our DAO, based on our latest Proposal on Liquidity [DCP-9]. There is already progress on improving this matter with the BNB liquidity program that implements Treasury Bills to develop protocol-owned liquidity (POL). The recently published report shows that the program has generated around $400,000 worth of POL, resulting in spending less RADAR for liquidity incentives.

We are at the next crossroads of improving our liquidity programs, decreasing the cost for incentivizing LPs, increasing the volume of protocol-owned liquidity, while ensuring that we remain decentralized and have an effective market for the current and future trading volume of RADAR. Taking this into consideration, this proposal comes in preparation of the next step for increasing the liquidity efficiency for RADAR by migrating to Sushi V3.

Migrating RADAR liquidity to V3

The latest version of Sushi’s decentralized exchange, V3, has been launched recently. It’s comparable to the renowned Uniswap V3. The new version brings enhanced features in the management of LP funds, particularly in terms of concentrated liquidity. Learn more about V2 vs V3 differences.

This feature empowers liquidity providers to choose the exact price ranges where they offer liquidity. This ensures a more efficient liquidity provision process with reduced price slippage and minimized impermanent loss. Consequently, transitioning RADAR to Sushi V3 from V2 leads to a higher concentration of liquidity around the market’s average prices, thereby offering traders less price slippage.

We will actively work with V3 liquidity managers to create an effective strategy and target liquidity volume that takes into consideration our average trading volume, price volatility, and ancillary costs such as LP incentives and management fees.

The V3 rewards structure will be different and will be structured around the new V3 mechanic and it can include native V3 Sushi rewards but also an auto-pool (for automatic rebalancing - What is this?). The gas fees for rebalancing the auto-pool will have to be covered by the DAO, but it will enable an efficient market, even during volatile periods.

We’re currently in touch with several V3 liquidity managers and assessing the best strategies for the RADAR pools, learning about the cost management of the pool balancing, and working out the right parameters like the average trading volume, price volatility, and ancillary costs (e.g.: LP incentives and management fees).

A new proposal for Sushi V3 migration will be shared with everyone as soon as the strategies are developed and ready to be shared with the DAO community.

Strategic Liquidity Optimization

This migration presents an opportunity to optimize liquidity provision over time. The goal is to migrate from V2 to V3 on all the existing and upcoming chains to ensure an efficient market for RADAR. This strategic approach ensures the seamless integration of liquidity management and standardizes the mechanism across the chains, therefore the V2 LP rewards will be reduced over time as we transition to V3.

Summary

For the next extension of LP rewards, the proposal suggests using the remaining unclaimed Airdrop tokens and maintain the rewards for Sushi to extend liquidity farming rewards on Sushi for 90 days (3 months) with a rate of 213,333 RADAR per day and a total of ~19,200,000 RADAR.

Benefits

- Extending the rewards for loyal LPs on Sushi V2 (Ethereum)

- Maintaining our cross-chain narrative by ensuring exposure to Ethereum users to gain access to providing liquidity to DappRadar

- Maintaining and potentially increasing liquidity in the RADAR-ETH pool and enabling low slippage for DEX trades

Drawbacks

- Distributing a large proportion of RADAR tokens that could be used for other initiatives

Vote

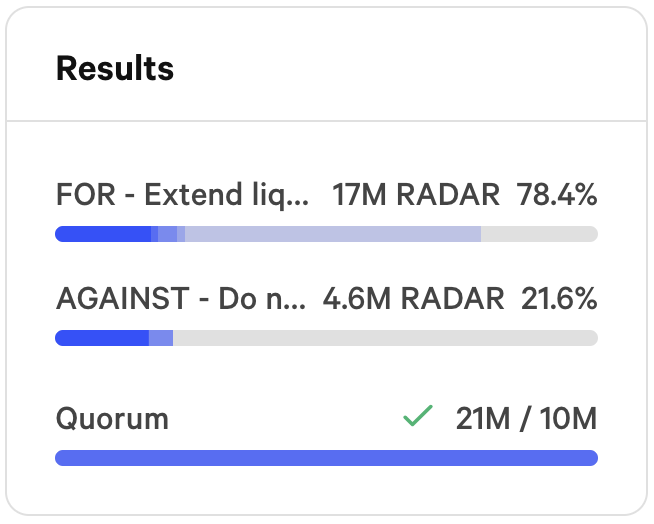

- FOR Extend liquidity rewards on Sushi V2 for 90 days (3 months) with a total of ~19,200,000 RADAR at a rate of 213,333 RADAR per day

- AGAINST - Do not extend liquidity rewards on Sushi V2