Summary

Since our first ApeSwap Treasury Bills Campaign in December 2022, we’ve had two back-to-back successful campaigns providing earning opportunities for our community, bringing more revenue for the DAO, and increasing our protocol-owned liquidity (POL).

In this report, we provide an overview of how the Treasury Bills Campaign performed in the previous campaign and how the data performed in general.

Thank you to @ApeSwapDAO for supporting us with the data.

1. DappRadar Sustainable Liquidity Mining Program Summary

| ApeSwap Bond | Vested Value | Acquired Value | R.O.E. |

|---|---|---|---|

| First | $ 136,622 | $ 117,849 | 86.26 % |

| Second | $ 458,432 | $ 382,075 | 83.34 % |

| Total | $ 595,054 | $ 499,924 | 84.01 % |

2. DappRadar Second ApeSwap Bonds

| Sold | Started | Vested Value | Ended | Acquired Value | Sale Duration | R.O.E. |

|---|---|---|---|---|---|---|

| 100% | 11/16/22 | $ 458,432 | 5/21/23 | $ 382,075 | 186 days | 83.34 % |

![]() Sold: Percentage of the total allocation to Bonds that were purchased by users.

Sold: Percentage of the total allocation to Bonds that were purchased by users.

Vested value: Total tokens paid out, multiplied by the token’s price at vesting time.

Acquired value: Sum of LPs deposited by users, multiplied by the price of the LP at the moment of purchase.

R.O.E: $AcquiredValue / VestedValue$

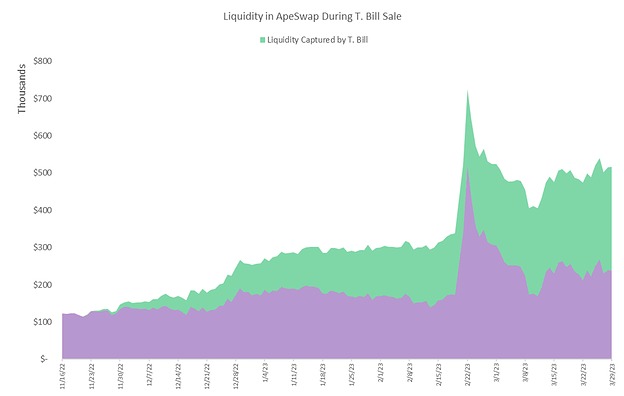

3. RADAR-WBNB Pair Liquidity During Second ApeSwap Bond

ApeSwap Bond Liquidity Growth (in USD)

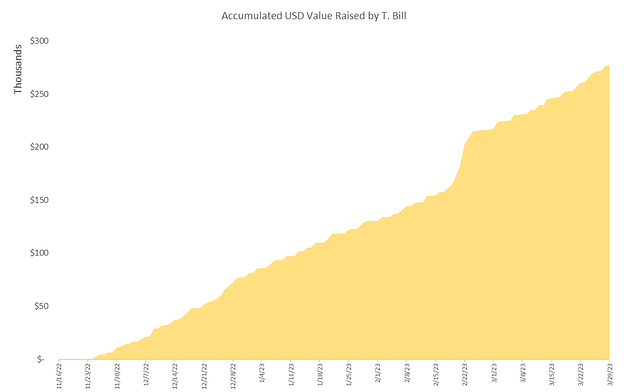

The figure below shows the accumulated liquidity raised since launching DappRadar’s second Bonds’ Allocation.

![]() This plot serves as an aprox. visual representation for the raised value. However, the exact measure of how much the Bonds have raised are the sum of the LPs that have been deposited on each purchase. Check the next section!

This plot serves as an aprox. visual representation for the raised value. However, the exact measure of how much the Bonds have raised are the sum of the LPs that have been deposited on each purchase. Check the next section!

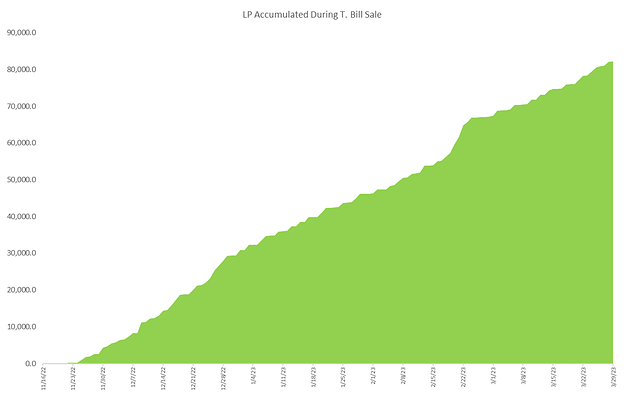

ApeSwap Bond Liquidity Growth (in LP’s)

The below graph shows the accumulated LP tokens raised by ApeSwap Bonds. The dollar amount of liquidity fluctuates given market volatility and impermanent loss. But the amount of LP tokens your protocol controls is always increasing with Bonds.

These LPs can regain value and are continuously growing given LPs are a yield-bearing asset! The LP value grows over time simply by holding them, which means our liquidity will naturally continue to grow over time.

![]() Total number of LP tokens raised with the second Bonds’ allocation: 112,109.8986 LPs

Total number of LP tokens raised with the second Bonds’ allocation: 112,109.8986 LPs

![]() Current value of LP tokens raised with the second Bonds’ allocation: $320,587

Current value of LP tokens raised with the second Bonds’ allocation: $320,587

Interesting Stats

- Number of unique buyers: 62

- Number of bills sold: 361

- Average Purchase: $1,057.88

- Biggest Purchase: $7,242

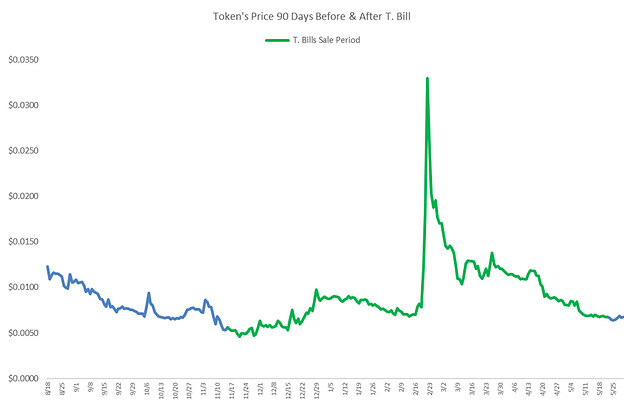

4. Token Price During Second ApeSwap Bonds’ Sale

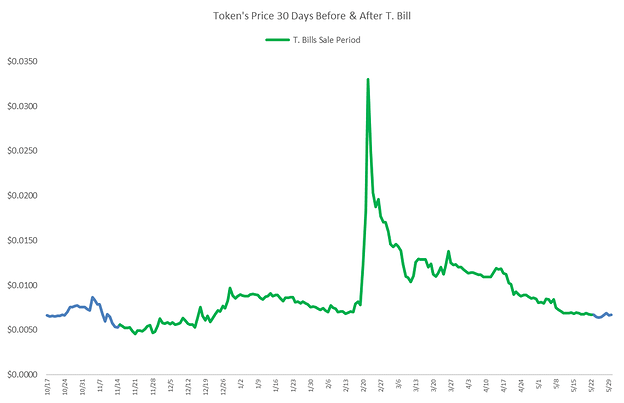

In the following figures, we can see that ApeSwap’s bonding program has no negative effect on the token’s price overall tendency.

5. Raising liquidity decreases slippage!

The following slippage calculator serves as an explanation to portray the positive effects of raising a better & deeper liquidity profile.

Deepening a token’s liquidity pool has the following benefits:

- Reduces slippage for every trade, which results in a lower arbitrage loss for the trader.

- Reduces the negative impact on token’s price for every trade.

As a result of these two main factors:

- Price becomes more stable and investors feel more attracted to the project due to increased stability and lower risks.

- The effect of the project’s emissions & scheduled vestings becomes less harmful to the token’s price.

- The project’s community can benefit from lower costs of trading the token.

- Decreases the risk of getting impacted by major market’s negative events, which for narrower liquidity project’s may imply going into a death spiral or getting almost all their liquidity drained and their price goes flat.

![]() Try it out!

Try it out!

6. ApeSwap Bonds’ R.O.E. vs Renting Alternative

ApeSwap team is strongly convinced that the adoption of traditional liquidity mining programs that involve renting (”farming”) as a project’s main strategy are totally outdated.

Traditional “farming” involves a huge investment from the project’s treasury that:

- Has strictly short impact on demand for the token, producing pumps & dumps on the token’s price between the starting and ending dates of the farms.

- Attracts yield mercenaries who take away huge amount of the farm’s rewards and just get away as soon as the program ends, “stealing” those rewards from the project’s real community, and leaving a huge dump in the project’s price that loyal community holders must bare with.

- Leaves literally no returns for the project’s treasury. All the value invested in rewarding the program is gone.

- As derived from above statements, continued and renewing farming programs can inflict tremendous damage to the project and it’s loyal investors by producing huge volatilities in price through those pumps & dumps, which will for sure panic many holders of the token, and may introduce a death spiral.

Through strong research, and the thorough analysis of data gathered on hundreds of projects that have reached to ApeSwap’s financial engineers with the objective of raising a better & long lasting liquidity profile at a minimum cost, is that we think we have finally arrived to an infinetly better alternative. Which in the case of Dapp Radar, has yielded the following outstanding results:

By adopting a sustainable liquidity mining strategy, the project was able to:

- Raise almost $500,000 in liquidity value.

- Provide a deeper liquidity pool for their community to trade against that is going to last for several months to come.

- Raise demand for their token & strengthen the price by reducing swap slippages with a long lasting deeper liquidity pool, and,

- Last but not least; become the owner of that freshly brewed liquidity.

Below we show ApeSwap Bonds’ return versus DappRadar’s traditional liquidity renting alternative. As we can see, Bonds are exponentially more effective and categorically a better use of capital.

| ApeSwap Bonds | Farming Scenario | |

|---|---|---|

| Token Budget (Sum of token’s value at Bonds’ purchase moment) | $ 595,054 | $ 595,054 |

| Value of LPs Acquired (Sum of LPs’ value at Bonds’ purchase moment) | $ 499,924 | $ 0 |

| R.O.E. | 84.01 % | 0 % |

7. Recommendation On Next Steps

![]() Given the Second ApeSwap Bonds allocation was a huge success, @ApeSwapDAO has strongly suggested DappRadar to keep involving in Sustainable Liquidity Mining programs.

Given the Second ApeSwap Bonds allocation was a huge success, @ApeSwapDAO has strongly suggested DappRadar to keep involving in Sustainable Liquidity Mining programs.